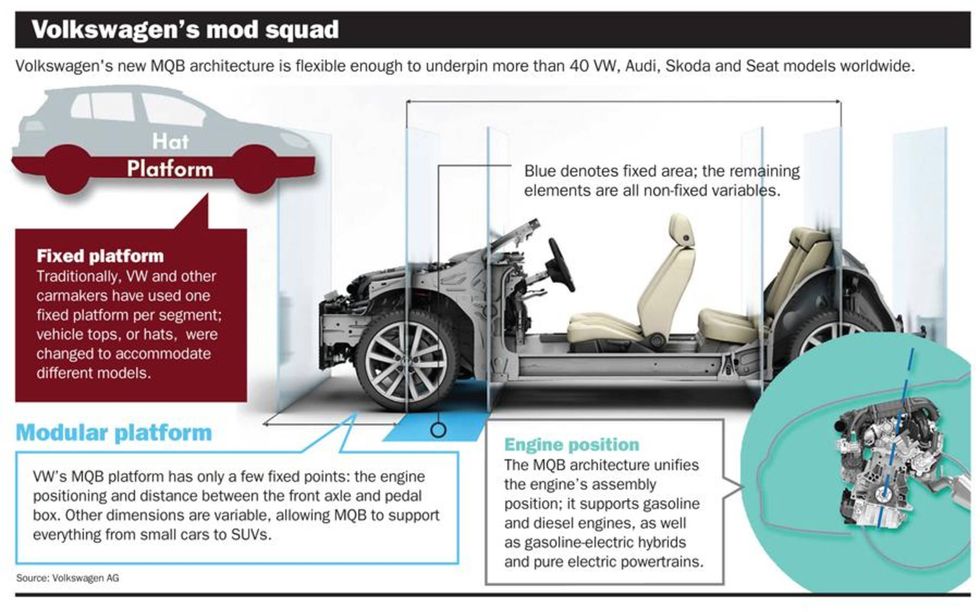

Volkswagen is pushing the global-platform concept to a level unprecedented in the auto industry, introducing a modular platform this summer that eventually will be the basis of microcars, sedans, crossovers and SUVs for its four largest brands.

While automakers now share platforms across brands and sometimes even segments, the VW initiative that starts this summer is far more ambitious than anything seen so far.

By 2017, some analysts estimate, the MQB platform that debuts with the Audi A3 eventually will be used in 4 million units a year--close to half of VW's annual production. VW says the plan will cut costs, slash production time and make the company far more nimble in adapting to market trends.

The MQB platform standardizes the engine positioning and the distance between the front axle and pedal box. The width, length and wheelbase can expand or contract according to model.

"It makes sense from both a cost standpoint and speed to market," said Jeff Schuster, senior vice president of forecasting at auto research firm LMC Automotive. "But it's a little bit of uncharted waters."

Along with the opportunities comes significant risk. It's an untested concept at this scale and could become a liability in the event of a massive recall, some analysts say.

By 2017, according to VW, the MQB platform will underpin more than 40 Audi, VW, Skoda and Seat models. The Audi A3 and VW Golf, the first cars built off the MQB, go on sale in Europe this year and in the United States in 2013.

All automakers are searching for ways to reduce manufacturing costs and boost profits as they scale up globally. VW, the world's No. 2 automaker in terms of sales, felt it needed a bold approach because of the sheer scale of its global 200-model lineup, a VW spokesman said.

"In order to control the naturally growing complexity in engineering and production, it is important to create the best available solution once and use it for as many models as technically possible," the spokesman said.

VW began developing the MQB platform in 2007, when Ulrich Hackenberg, who had developed a modular vehicle base at Audi, took over as VW Group's board member for r&d.;

With the MQB platform--from the German for "modular transverse matrix"--the width, length and wheelbase can expand or shrink to fit the needs of a particular nameplate. The base is flexible enough to accommodate gasoline and diesel engines, as well as gasoline-electric hybrids and pure electric powertains.

Two other global platforms already in place will account for the rest of the VW group's volume: the MLB, which supports bigger vehicles with longitudinally mounted engines, and the MSB for rear-engine sports cars.

Forecasting firm IHS Automotive predicts that by 2017 VW will build 4 million vehicles on the MQB platform. VW, which sold 8.3 million vehicles worldwide last year, ranking second to General Motors, declined to offer its own prediction and wouldn't talk about development costs.

VW has the largest-volume global platform, the PQ35, which underpins compact models. In 2012 VW is expected to build 3 million cars off the PQ35, according to IHS.

Toyota Motor Corp. has the second-highest-volume platform, the MC-M, which underpins big global sellers such as the Corolla and Camry, said Mario Franjicevic, a senior forecaster at IHS. By 2017, Toyota expects to build 3.4 million cars off this base, he said.

At VW's annual meeting in March, VW Group CEO Martin Winterkorn characterized the platform investment as "substantial," but wasn't specific.

The long-term payback, however, also is expected to be significant. With the MQB, VW expects to slash parts and development costs by 20 percent. It also seeks to cut production time by 30 percent.

The company plans to phase in the new platform with each new model redesign, the spokesman said.

The approach does have potential pitfalls.

"The plan could backfire any time in case of massive recalls," said Vishwas Shankar, an industry analyst with market research company Frost & Sullivan.

With so many vehicles sharing parts, any flaw could be repeated millions of times over, resulting in a costly and difficult fix for VW.

But more standard parts should make it easier to train dealership service personnel, Shankar said. Training costs for dealers is "expected to come down considerably," he added.

The VW spokesman said such concerns are understandable. But the company also believes by using a single platform rather than multiple designs, engineers will be able to pinpoint problems faster.

VW could potentially cut its vehicle development time to two years, said Frost & Sullivan's Shankar. Typically, VW and other manufacturers starting from scratch can take as long as four years to bring a new car to market, he added.

IHS' Franjicevic said VW isn't the only car company using a modular kit. Mercedes-Benz, for instance, has a version. But VW is the first to use it on such a massive scale.

Potential benefits VW's MQB platform plan:

-- More flexibility, will underpin more than 40 models

-- Will cut production time by 30%

-- Will reduce parts and engineering costs by 20%

-- Greater parts sharing among models, regions

-- Potential to slash new-model development time