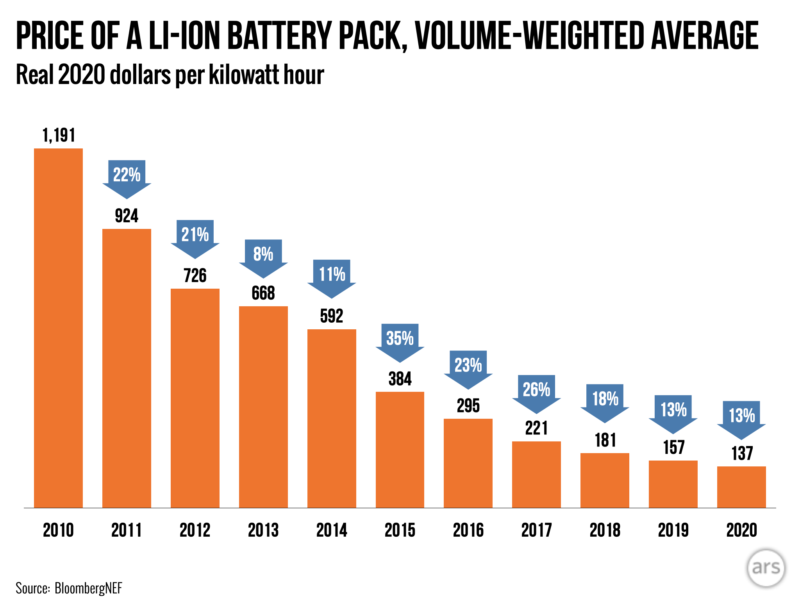

The average cost of a lithium-ion battery pack fell to $137 per kWh in 2020, according to a new industry survey from BloombergNEF. That's an inflation-adjusted decline of 13 percent since 2019. The latest figures continue the astonishing progress in battery technology over the last decade, with pack prices declining 88 percent since 2010.

Large, affordable batteries will be essential to weaning the global economy off fossil fuels. Lithium-ion batteries are the key enabling technology for electric vehicles. They're also needed to smooth out the intermittent power generated by windmills and solar panels.

But until recently, batteries were simply too expensive for these applications to make financial sense without mandates and subsidies. Now, that is becoming less and less true. BloombergNEF estimates that battery-pack prices will fall to $100 per kWh by 2024. That's roughly the level necessary for BEVs to be price-competitive with conventional cars without subsidies. Given that electric vehicles are cheap to charge and will likely require less maintenance than a conventional car, they will be an increasingly compelling option over the next decade.

A virtuous circle

Like most high-tech goods, batteries tend to get cheaper as they are manufactured at higher volumes. As the world builds more and more electric cars, grid storage installations, and other battery-based systems, higher volumes will drive prices lower and lower.

Economists define the "learning rate" as the percentage decrease in price for every doubling of output. BloombergNEF estimates that the learning rate for batteries is about 18 percent: every time global battery output doubles, prices fall by 18 percent.

Battery prices declined 13 percent between 2018 and 2019 and another 13 percent by 2020. These are certainly significant improvements, but the rate of progress seems to be slowing. Battery prices declined at an average annual rate of 19 percent between 2010 and 2018.

BloombergNEF attributes the slowing pace of progress to slowing growth of volume in the battery industry. In absolute terms, battery shipments are growing faster than ever. But now that the industry is much bigger—BloombergNEF estimates it grew by a factor of 264 between 2010 and 2020—it will be difficult for the industry to match earlier growth rates in percentage terms. And that's likely to translate to a slower—but still significant—percentage decline in battery prices.

Specifically, BloombergNEF projects that battery pack prices will fall to $58 per kWh in 2030 and to $44 per kWh in 2035.

These prices would give electric cars a substantial price advantage over conventional vehicles. They would allow much greater use of renewable energy sources on the electric grid. And they might enable new uses for batteries that aren't economically viable today.

“We leverage our contacts”

The BloombergNEF report is particularly interesting because the details of most battery transactions are confidential. So data on battery prices wouldn't otherwise be available to the public.

"We leverage our contacts across all sectors of the value chain," said James Frith, the lead author of BloombergNEF's annual battery survey, in an interview with Ars earlier this year. "We talk to both end users as well as manufacturers and other people working in the industry. We talk to most of the large auto makers who are active in the electric vehicle space and the majority of the tier 1 battery manufacturers in China, Europe, the US, and South Korea."

Bloomberg NEF doesn't reveal individual prices, but it aggregates them to provide averages broken down by geography and industry sector.

Not everyone was willing to talk to BloombergNEF. For example, the firm estimates that Tesla's battery pack costs fell from $128 per kWh in 2019 to $115 per kWh in 2020. Presumably, they had to estimate these prices because Tesla declined to provide figures directly.

Those are some of the lowest figures in the industry, especially for a company outside of China. BloombergNEF estimates that Tesla was responsible for 25 percent of the global BEV market in 2020.

China dominates the market

The absolutely lowest prices in the industry were in China, which had three-quarters of the world's battery manufacturing capacity in 2020. For the first time ever, a few Chinese companies reported battery pack prices below $100 per kWh. Interestingly, the lowest prices in the world were for large battery packs used in Chinese electric buses and commercial trucks. The average pack price for batteries in these Chinese vehicles was $105 per kWh, compared to $329 for electric buses and commercial vehicles in the rest of the world.

There are several reasons for this gap, including the fact that Chinese manufacturers are more likely to use cheap lithium iron phosphate chemistries in batteries for electric buses. But the fundamental issue seems to be that the bus and commercial vehicle market has developed much further in China than elsewhere. Large production volumes give vehicle-makers anywhere more leverage to demand lower prices. Chinese companies make a lot of electric buses and commercial vehicles, so they have the most leverage. Hence, we can expect significant price declines as the electric bus industry matures in the United States and elsewhere.

Another trend that will be increasingly important in the coming years is the integration of battery cells directly into vehicles—a trend Tesla discussed at its recent battery day event. So far, all the battery prices I've cited have been pack prices, which includes not only the battery cell but also charging circuitry and the physical housing. The price of bare cells is typically about 30 percent lower than the price of a pack with the same cells inside of it.

If other car companies follow Tesla's lead and incorporate battery cells directly into the car chassis, then "battery pack price" may stop being a meaningful figure for many electric vehicles. Fortunately, BloombergNEF has tracked both cell and pack prices going back to 2010.

Listing image by Getty Images

reader comments

512